Business Insurance in and around Salem

Looking for small business insurance coverage?

Cover all the bases for your small business

State Farm Understands Small Businesses.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes accidents like a staff member getting hurt can happen on your business's property.

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Business With State Farm

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or business continuity plans, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Camron Erway can also help you file your claim.

Take the next step of preparation and visit State Farm agent Camron Erway's team. They're happy to help you identify the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

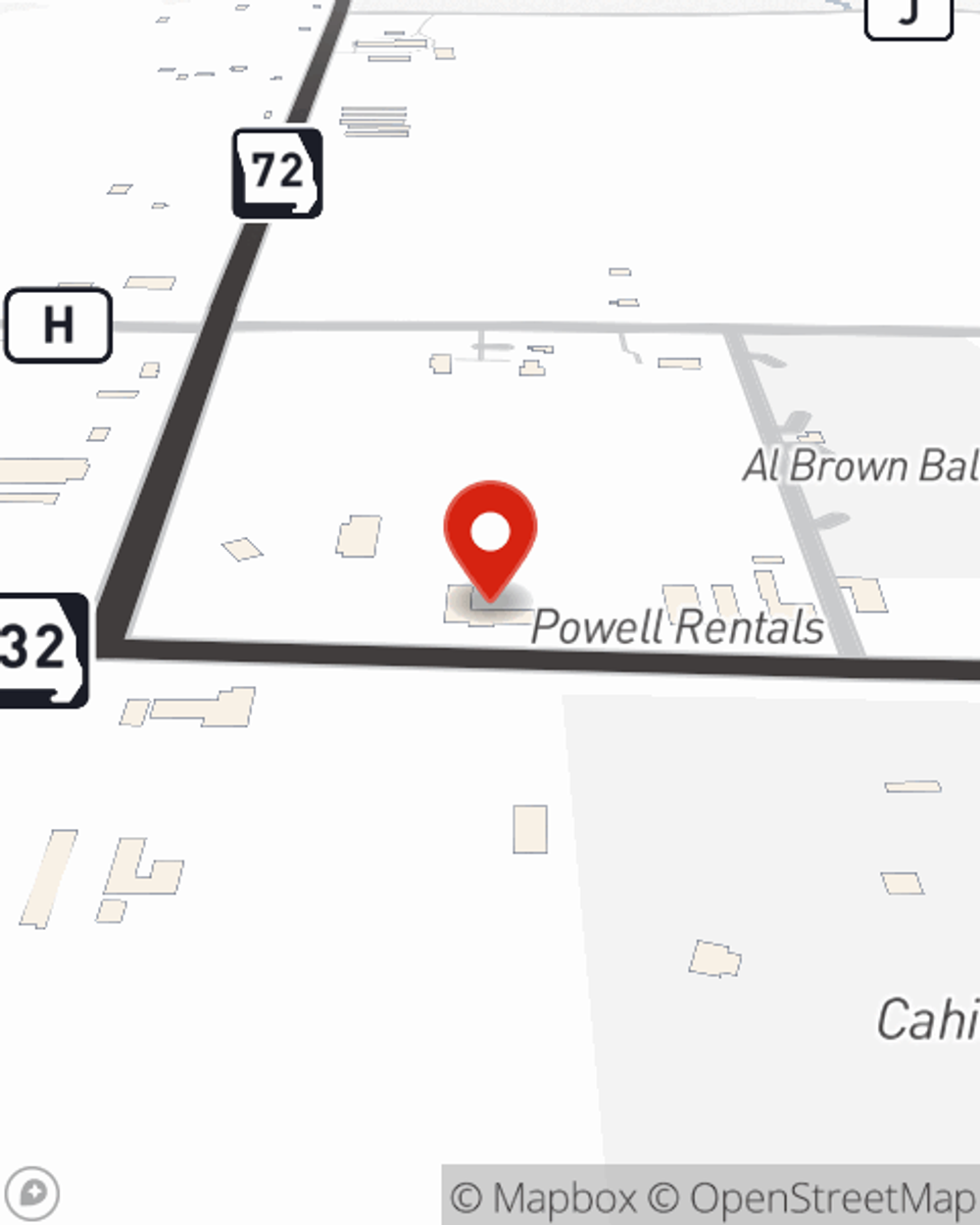

Camron Erway

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.