Condo Insurance in and around Salem

Condo unitowners of Salem, State Farm has you covered.

State Farm can help you with condo insurance

There’s No Place Like Home

Your condo is your home. When you want to relax, rest and catch your breath, that's where you want to be with the ones you love.

Condo unitowners of Salem, State Farm has you covered.

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

That’s why you need State Farm Condo Unitowners Insurance. Agent Camron Erway can roll out the welcome mat to help build a policy for your particular situation. You’ll feel right at home with Agent Camron Erway, with a no-nonsense experience to get reliable coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Camron Erway can help you file your claim whenever life goes wrong. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Don’t let the unexpected about your condo make you unsettled! Get in touch with State Farm Agent Camron Erway today and discover how you can save with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Camron at (573) 729-3056 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

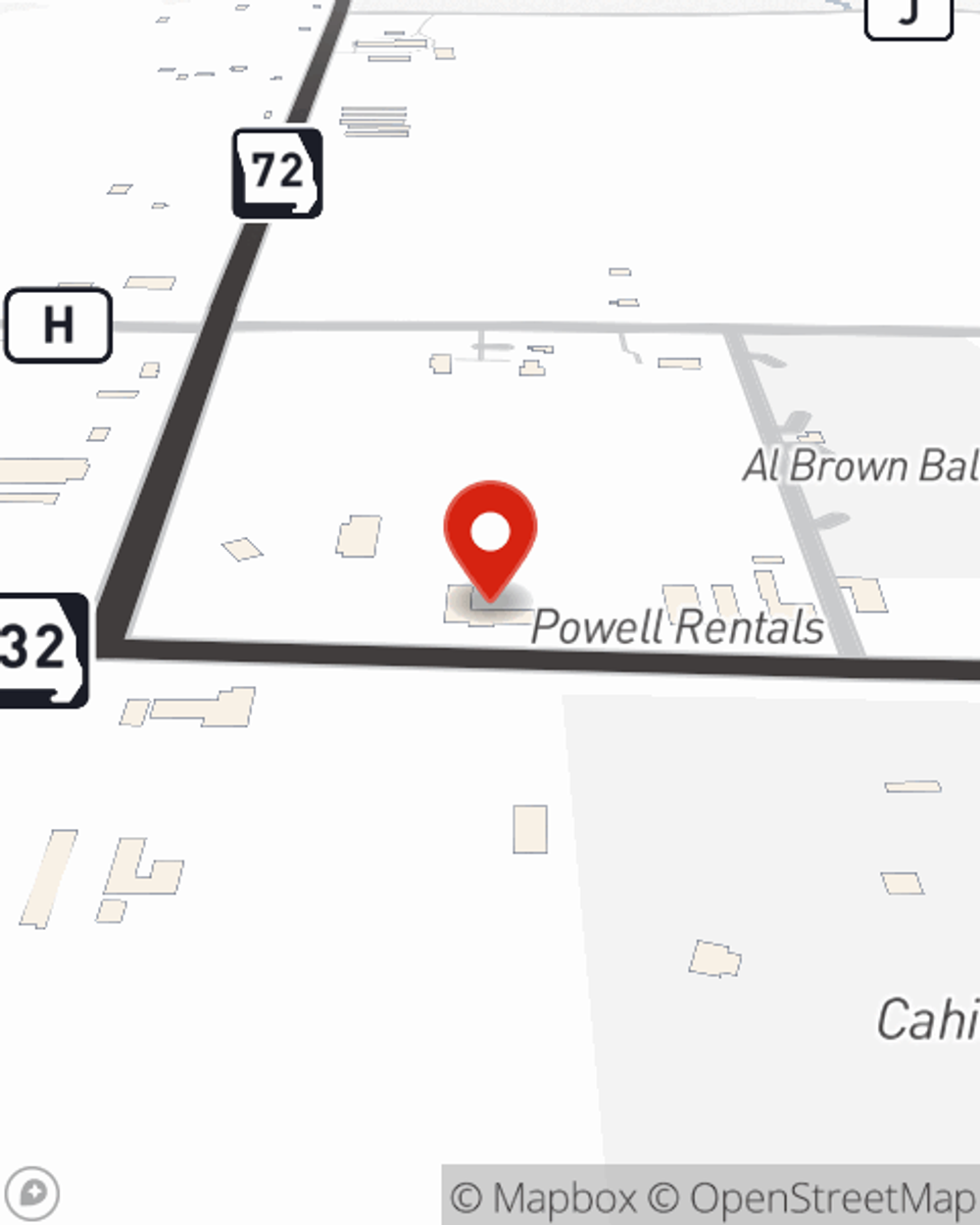

Camron Erway

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.