Life Insurance in and around Salem

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

State Farm understands your desire to protect your partner after you pass. That's why we offer great Life insurance coverage options and reliable caring service to help you select a policy that fits your needs.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Why Salem Chooses State Farm

When choosing how much coverage is right for you, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like how old you are, your health status, and perhaps even personal medical history and occupation. With State Farm agent Camron Erway, you can be sure to get personalized service depending on your specific situation and needs.

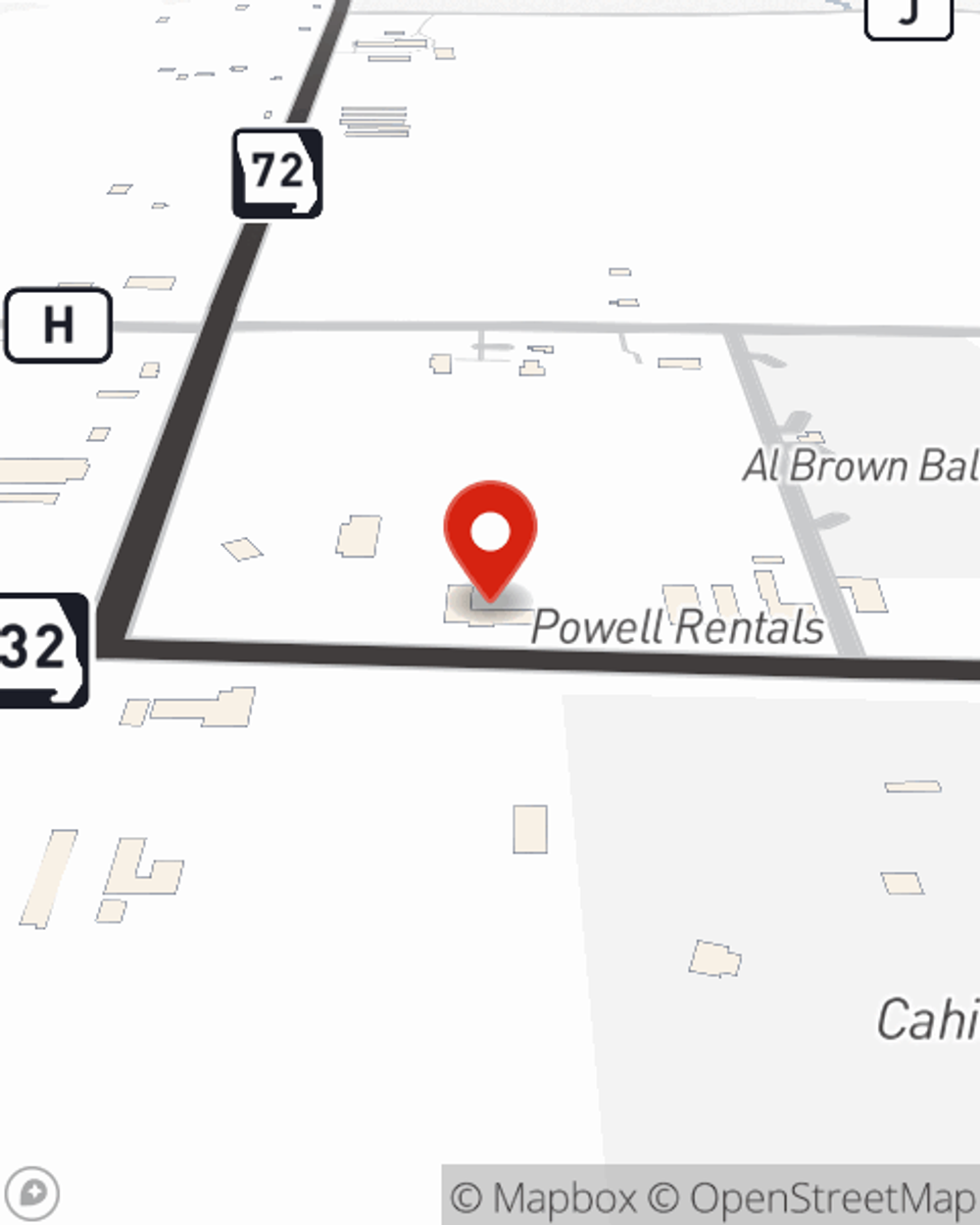

To find out State Farm's Life insurance options, reach out to Camron Erway's office today!

Have More Questions About Life Insurance?

Call Camron at (573) 729-3056 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Camron Erway

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.